Ellyn Savage

SVP, Global Media

Audio Time Spent Growth

By next year, a fifth of all time spent with interactive digital media in the US will go to digital audio. Spotify will take up almost an hour per day this year, and Pandora will take 48 minutes. Over half of digital audio listeners are tuning in to podcasts at least once a month.

Perhaps surprisingly, over 80% of the US adult population still listens to terrestrial radio at least once per month. Edison Research found that terrestrial radio still claims 40% of total audio time among US adults.

Of note, there is a disconnect between time spent and share of ad dollars, with too much being spent on Meta, desktop, and mobile, and too little being spent on YouTube, CTV, and audio platforms. Daily audio time is exceeded only by traditional TV and CTV, but it draws less than 5% of total US ad spending.

Audio is an opportunity for advertisers on any platform, terrestrial or digital.

Podcast Advertising Opportunity

In the US, podcasts hit a saturation point post-Covid with growth slowing a bit. News shows in particular are struggling to find an audience, due to an already crowded competitor landscape.

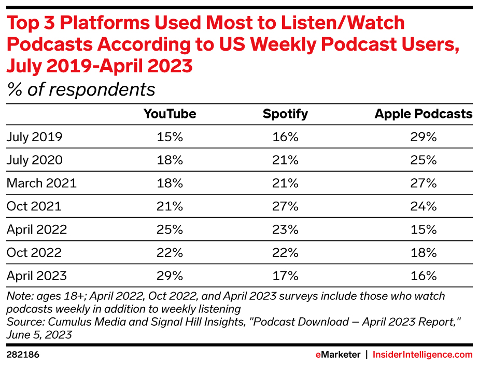

YouTube is now the most popular podcast platform in the US (33% listeners), overtaking Spotify (24%), Apple Podcasts (12%), and Pandora (7%). US podcast ad spend is forecasted to grow 28.8% this year to reach $2.25 billion. We expect podcast listenership to surpass 150 million by 2027. By comparison, Instagram’s US user base is around 130 million.

US adults will spend 3.1% of daily media time with podcasts, but only 0.8% of digital ad spending goes to podcasts. Advertisers can buy directly from platforms or go to networks, such as Gimlet (division of Spotify), NPR, and Midroll.

45% of marketers surveyed said podcast ads are extremely effective (vs. 62% for social media). 33% of podcast listeners have purchased a product or service because of a podcast ad, particularly millennials and those making $100k+ per year. Podcasts represent a major opportunity for advertisers to reach consumers.

Spotify Pivots to Compete with YouTube

In 2022, Spotify was still the top platform for buying podcast ads, followed closely by YouTube, despite YouTube surpassing Spotify for users in 2023. Spotify has shifted focus to creating a UGC and video mass marketplace to compete with YouTube and TikTok, pivoting away from developing and acquiring exclusive content. With this shift, smaller shows are taking up ad dollars. Advertisers are diversifying budgets to a larger variety of podcast shows.

Paid Audio Subscriptions

By 2026, roughly half of all US internet users will spend money to eliminate or reduce ads during their audio time. Perhaps over time, this will create a supply and demand issue for advertisers, driving up audio ad prices.

Retail Audio

One exciting audio opportunity we’re hearing about is in-store audio. Walmart is introducing ad spots to Walmart’s in-store radio.

Audio Bottom Line

We have lots of room for audio ad spend growth before we catch up to demand. To create a comprehensive ad spend plan, get in touch with our media experts.